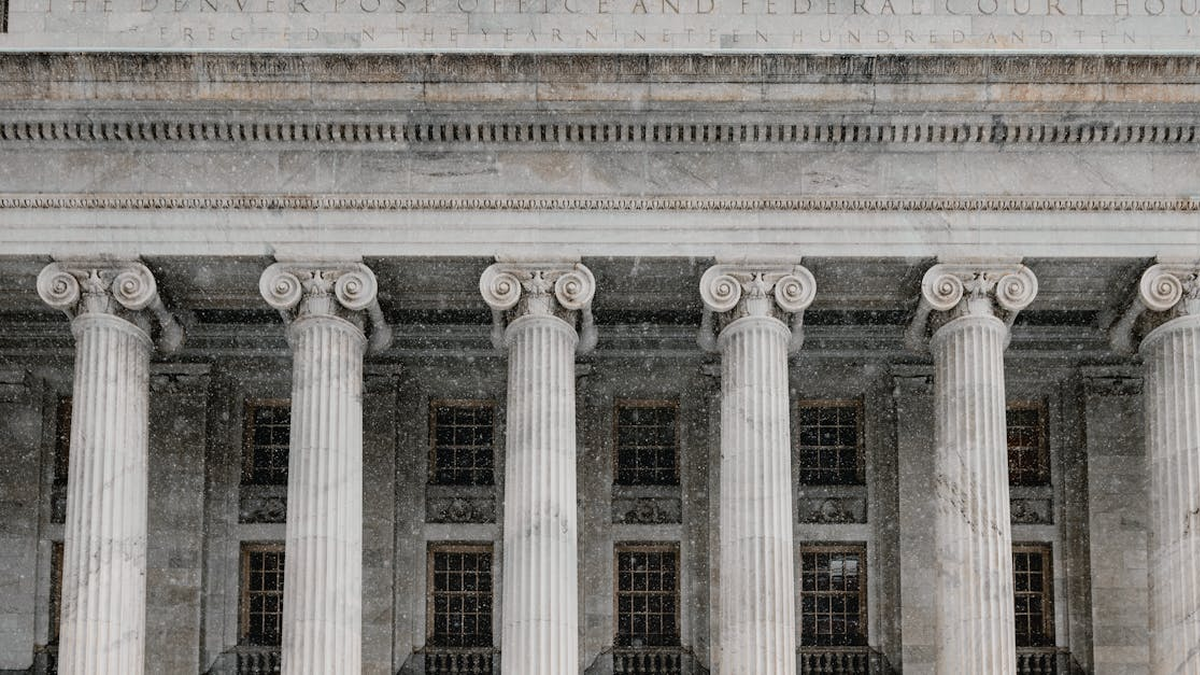

Supreme Court IEEPA Tariff Case: Potential Refund Opportunities for Importers

Authored By GreerWalker

If your company has paid tariffs under the International Emergency Economic Powers Act (IEEPA) over the past year, you may be entitled to significant refunds depending on the outcome of a pending Supreme Court case. The financial impact could be substantial, with an estimated $75-$85 billion in IEEPA-related duties collected since April 2025.